Suppose That the Average Stock Has a Volatility of 50

All stocks are equally weighted. If two rægatively their is a.

This Tiny Hedge Fund Just Made 8 600 On A Vix Bet What A Bet How Do They Find It Timeless Investo Implied Volatility Volatility Index Volatility Trading

You currently hold a portfolio of three stocks Delta Gamma and Omega.

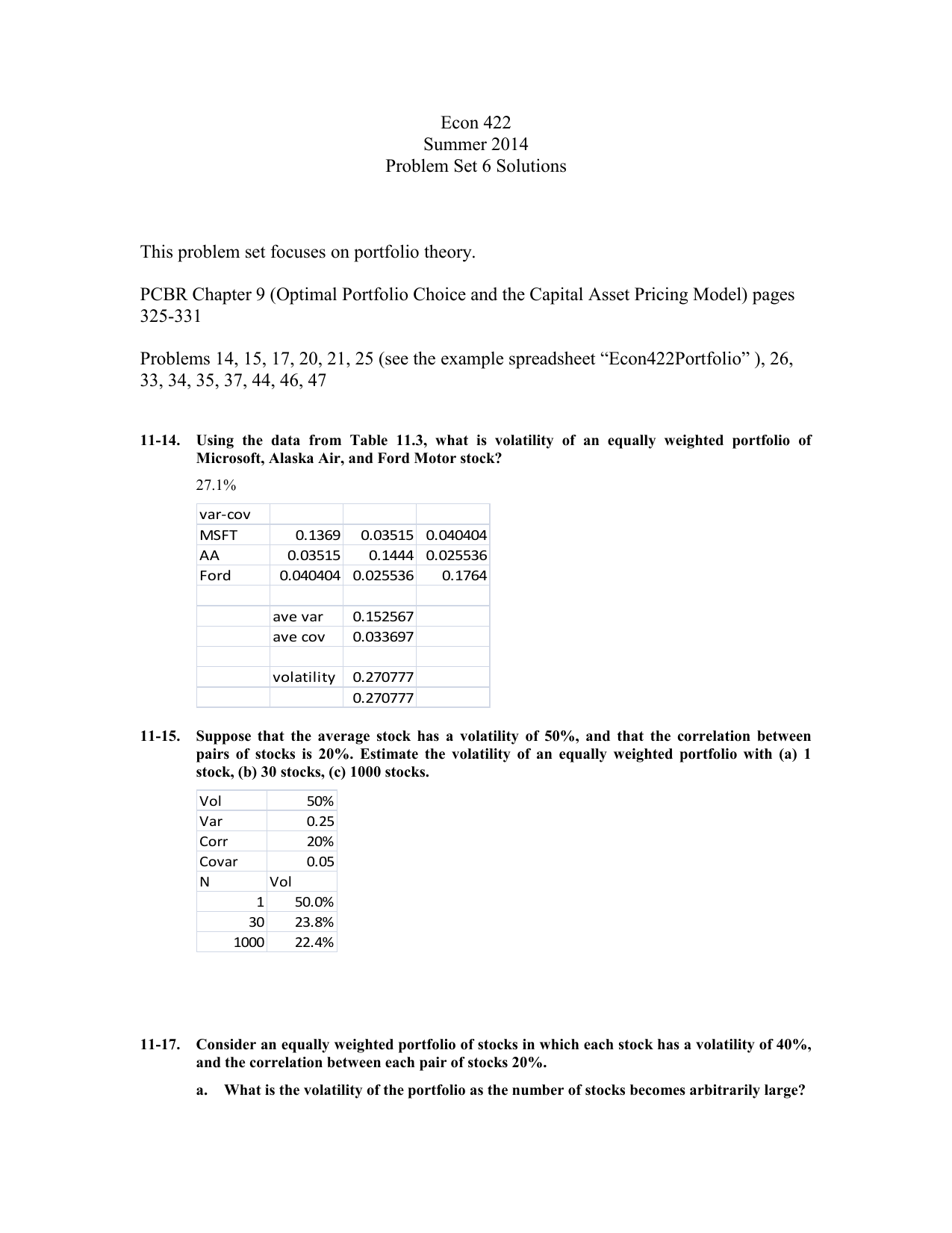

. Suppose the average stock has a volatility of 50 and the correlation between pairs of stocks is 20. Estimate the volatility of an equally weighted portfolio with a 1 stock b 30 stocks c 1000 stocks. Suppose the average stock has a solatility of 50 and the correlation betwœn pairs of stocks is 20.

Finance questions and answers. Suppose that the average stock has a volatility of 48 and that the correlation between pairs of stocks is 16. Suppose that the average stock has a volatility of 48 and that the correlation between pairs of stocks is 20.

Estimate the volatility of an equally weighted portfolio with a 1 stock b 30. Suppose you estimate that stock A has a volatility of 32 and a beta of 142 whereas stock B has a volatility of 68 and a beta of 075. Estimate the volatility of an equally weighted portfolio with.

A Applying the formula the volatility when there is one stock is. If Tex and Mex are uncorrelated a. Suppose that the average stock has a volatility of 50 and that the correlation between pairs of stocks is 21.

10 10 9 10 8 30 7 60 80 100 5 4 3 2 60 50 40 40 20. Calculate the p weights that is in. A Which stock has more total risk.

11-19Stock A has a volatility of 65 and a correlation of 10 with your current portfolio. Suppose that the average stock has a volatility of 51 and that the correlation between pairs of stocks is 17. Chapter 11 Optimal Portfolio Choice and the Capital Asset Pricing Model 111 Suppose that the average stock has a volatility of 50.

Suppose that the average stock has a volatility of 50 and. What is the average. Assume that the CAPM assumptions hold.

If the correlation between these stocks is 25 what is the volatility of the following portfolios of Addison and Wesley. Stock B has a volatility of 30 and a. C Suppose the risk-free rate is 2 and you estimate the markets expected return as 10.

Suppose that the average stock has a volatility of 48 and that the correlation between pairs of stocks is 16. Estimate the volatility of an equally weighted portfolio with. Your investment portfolio consists of 10000 worth of Google stock.

Suppose that the average stock has a volatility of 50 and that the correlation between pairs of stocks is 20. Suppose that the average stock has a volatility of 50 and that the correlation between pairs of stocks is 20. B Which stock has more market risk.

When the stock price at the end of a certain day is 50 calculate the following. Question 16 Suppose that the average stock has a volatility of 50 and that the correlation between pairs of stocks is 20. Suppose that the average stock has a volatility of 50 and that the correlation between pairs of stocks is 20.

Suppose that the risk-free rate is 4 Google stock has an expected return of 14 and a volatility of 35 and the market portfolio has an expected return of 12 and a volatility of 18. Estimate the volatility of an equally weighted portfolio with. A The expected stock price at the end of the next day.

Estimate the volatility of an equally weighted portfolio with. Answer to Suppose the average stock has a volatility of 50 and the correlation between pairs of stocks is 20. Suppose Wesley Publishings stock has a volatility of 60 while Addison Printings stock has a volatility of 30.

Finance questions and answers. Suppose the average stock has a volatility of 50 and the correlation between pairs of stocks is 20. Wt being the relative weight of a stock in the portfolio and sd is the standard deviation of a stock measuring its volatility.

The Optima Mutual Fund has an expected return of 20 and a. Details about stock volatility and correlation between them. Suppose Intels stock has an cxpccxcd rccurn of 26 and volatility of 50 while Coca-Colas of 6 and volatllity of 25.

Business Finance QA Library Suppose that the average stock has a volatility of 53 and that the correlation between pairs of stocks is 18. Estimate the volatility of an equally weighted portfolio SolutionInn. Estimate the volatility of an equally weighted portfolio with.

Var Rp 1n x Average variance of the individual stocks 1 1n x Average covariance between the stocks a. Suppose that the average stock has a volatility of 50 and that the corr elation between pairs of stocks is 20. Estimate the volatility of an equally weighted portfolio with a 1 stock b 30 stocks c 1000 stocks.

Estimate the volatility of an equally weighted portfolio with. Estimate the volatility of an equally weighted portfolio with. Suppose the average stock has a volatility of 50 and the correlation Suppose the average stock has a volatility of 50 and the correlation between pairs of stocks is 20.

Finance questions and answers. Eqsqrtdfrac5021 1 - 1 150220 50 eq b When there are 30 stocks the volatility is. Calculate EX and construct a histogram for these data.

B The standard deviation of the stock price at the end of the next day. A 100 Addison b 75 Addison and 25 Wesley and c 50 Addison and 50 Wesley. Estimate the volatility of an equally weighted portfolio with.

The volatility of an equally weighted portfolio with 1 stock is Round to two decimal places. Which firm has a higher cost of equity. Answer to Suppose Tex stock has a volatility of 40 and Mex stock has a volatility of 20.

1 stock Volatility 50. 11-16Suppose that the average stock has a volatility of 50 and that the correlation between pairs of stocks is 20. Variance sd 2 of the portfolio wt a sd a2 wt b sd b2 2 wt a wt b sd a sd b Correlations between stocks a.

The volatility of the various portfolio combinations of Addison and Wesley will be derived from the formula. Suppose Wesley Publishing stock has a volatility of 65 while Addison Printing stock has a volatility of 25. Suppose that the average stock has a volatility of 50 and that the correlation between pairs of stocks is 20.

Suppose that a stock price has an expected return of 16 per annum and a volatility of 30 per annum. Suppose that the average stock has a volatility of 48 and that the correlation between pairs of stocks is 20. Estimate the volatility of an equally weighted portfolio with a 1 stock b 30 stocks c 1000 stocks.

114 Stock A has a volatility of 65 and a correlation of 10 with your current portfolio. Estinute volatility OF with a I stock b 30 c. Estimate the volatility of an.

Estimate the volatility of an equally weighted portfolio with a 1 stock b 30 stocks c 1000 stocks.

R Stocks Calculating Volatility Of A Time Series Stack Overflow

:max_bytes(150000):strip_icc()/dotdash_Final_Enter_Profitable_Territory_With_Average_True_Range_Jun_2020-01-cdd2be9718e1407a8d58e3f306585c7c.jpg)

No comments for "Suppose That the Average Stock Has a Volatility of 50"

Post a Comment